The BCG matrix also called 'growth - market share'. It is a simple and intuitive tool for portfolio analysis. The availability and originality of the chart sectors names made it very popular among marketers and managers. Let’s consider the example of building a matrix in Excel.

- Bcg Matrix Of Microsoft Company

- Bcg Matrix Of Microsoft Company Information

- Bcg Matrix Of Microsoft

- Bcg Matrix Of Microsoft Company Information

Examples of using the BCG matrix

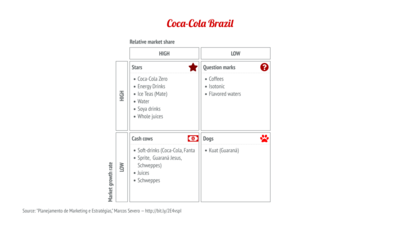

The BCG Matrix, otherwise. BCG Matrix Template Excel Features Now generate even more revenue from your company products through getting this template. It helps in managing both smaller and larger companies. Although BCG matrix, is actually requirement of bigger companies, still smaller and medium size companies are also able to use it efficiently. The BCG Matrix is one of the most popular portfolio analysis methods. It classifies a firm’s product and/or services into a two-by-two matrix. Each quadrant is classified as low or high performance, depending on the relative market share and market growth rate.

- Devised as a portfolio planning tool, or corporate planning tool, the BCG growth-share matrix was first conceived by Bruce Henderson of the Boston Consulting Group back in the 1970's. The concept is based on four quadrants in which a company's strategic business units (SBU) or products/brands are classified.

- The BCG matrix: an example of construction and analysis in Excel. Let’s consider the construction of the BCG matrix on the example of an enterprise. Preparation: Collect data and build the source table. A list of elements to be analyzed is made up at the first stage. It can be goods, assortment groups, company branches or enterprises.

Using the matrix of the Boston Consulting Group (BCG) you can quickly and visually analyze the product groups and branches of the company. You can proceed company analysis based on their share in the relevant market segment and in the market growth rate. The using of the tool is based on two hypotheses:

- The leader in the market has a competitive advantage in production costs. Consequently, the leading company has the highest profitability in the segment.

- An enterprise needs to invest a lot in the development of its product to work effectively in a fast-growing market. The presence in the segment with a low growth rate allows the company to reduce this expense item.

With the help of the BCG matrix, it is possible to quickly identify the most promising and the 'weakest' goods (branches, companies). You can make a decision on the basis of the received data: what assortment group (division) to develop, and which of them needs to be liquidated.

All the analyzed elements go into one of four quadrants after the analysis work:

- 'Problems'. Products represented in fast-growing industries, but having a low market share., You need significant financial investments to strengthen their position in the market. The enterprise decides whether it has sufficient funds for the development of this assortment group or division if these directions fall into this quadrant. The product does not develop without cash injections.

- 'Stars'. Business directions and products are leaders in a fast-growing market. The task of the enterprise is to support and strengthen these products. The best resources should be allocated to them because it is a stable source of profit.

- 'Moneybags'. Goods with a relatively high market share in the slowly growing segment. They are the main generator of money and do not need high investment. It’s sales revenues should go to the development of 'stars' or 'wild cats'.

- 'Dead weight'. A characteristic feature is the relatively low market share in the slowly growing segment. These directions do not make sense.

The BCG matrix: an example of construction and analysis in Excel

Let’s consider the construction of the BCG matrix on the example of an enterprise. Preparation:

- Collect data and build the source table. A list of elements to be analyzed is made up at the first stage. It can be goods, assortment groups, company branches or enterprises. It is necessary to specify the volume of sales (profit) and similar data of a key competitor (or a number of competitors) for each indicator. The initial data is entered in the table. * The analyzed period can be different (month, quarter, half a year). But the closer this indicator to the year, the higher it’s objectivity (since seasonality does not affect the figures).

- Calculation of the growth market rate. It is necessary to calculate how much the sales volume has increased/decreased in comparison with the previous period. To do this we need data on the sales for the previous period.

- The formula for calculating the growth market rate in Excel:* The percentage format is set for cells in column D.

- Calculation of the relative market share. For each of the analyzed products, you need to calculate the relative market share towards a similar product for a key competitor. To do this you have to divide the sales volume of the enterprise product by the sales volume of a similar product of the competitor.

Building the BCG matrix

The best tool for these purposes is a bubble chart in Excel.

Add the construction area to the sheet using the 'INSERT'-'Charts'-'Scatter'-'Bubble'. We enter the data for each line as follows:

After select: 'CHART TOOLS'-'DESIGN'-'Select Data'-'Add':

On the horizontal axis is the relative market share (set the logarithmic scale: 'CHART TOOLS'-'FORMAT'-'Current Selection'-'Horizontal (Value) Axis'). On the vertical is the rate of market growth. The area of the diagram is divided into 4 identical quadrants:

Central value for the growth market rate is 80%. For the relative market share is 1.00. We will distribute commodity categories taking into account these data:

Conclusions:

Bcg Matrix Of Microsoft Company

- 'Problems' - Item №1 and №4. Investments are needed to develop these goods. Scheme of development is next: creating a competitive advantage - distribution - support.

- 'Stars' - Item №2 and №3. The company has such categories and this is a plus. At this stage, only support is needed.

- 'Cash Cows' - Item №5. Brings a good profit which can be used to finance other products.

- 'Deadweight' is not found.

It is desirable to preserve this state of affairs as long as possible. Subsequently, we need to analyze the prospects of 'Difficult children' more deeply: is it possible to turn them into 'Stars'.

Microsoft Corporation is an American technology company. It’s headquarter is located in Redmond Washington USA. It was founded by two friends, Bill gates and Paul Allan; on April 4, 1975, in New Mexico. Microsoft operates in multiple industries which are as follow, computer hardware, computer software, digital distribution and consumer electronics. The foundation of the company was built on, developing interpreting system for Altair 8800, eventually, company became market leader in computer operating system developing industry. Unfortunately, company has lost its market share to android in operating system industry. Some of the operating systems developed by Microsoft are, Windows 7, Windows 8.1, Window xp, window8, window Vista and others. Windows 7 was a big success on the part of Microsoft, in operating system industry. 2009-2015 windows 7 seized the highest market share compare to, Microsoft other operating systems. Presently, Apple and Google are the core competitors of Microsoft in operating systems. Moreover, Microsoft Corporation operates in gaming industry, X-box and other complementary product and software related to the product is also the creation of company. 2015-2016 Microsoft bought two eminent companies LinkedIn and Skype technologies.

Gigantic Corporation like Microsoft is not easy to manage, as mentioned in introduction that, Corporation has multiple operating segment and each segment operates in distinct industry. For such organization formulation of strategy can be very complicated for top-level management. Therefore, to cope with the problem top-level managers use tools to formulate distinct strategy for each segment according to its needs. BSG Matrix is one of the tool which can be useful for top level manager to cope with dilemmas like, which strategy should be adopted for which segment? BCG Matrix was developed by a private consulting firm, based in Boston; “Boston consulting firm”. This matrix was specially designed for those companies which have multiple profit centers or operates in multiple industries. BCG Matrix is a four quadrants graphic representation of multiple segments, which can be analyze by means of Market share and Industry sales growth rate. Following are the categories of segments in BCG matrix; Cash cows, Dogs, Question mark and Stars. BCG matrix examination of Microsoft is given below.

Question Mark

Those segments are included into the category of Question mark which have low relative market share and operate in high sales growth industry. Microsoft Phone hardware segment comes into the category of question mark, following products are manufactured by Microsoft in mentioned segment; Lumia and non-Lumia phones. When android phones were introduced most of the customers of windows cell phone switched to android which almost occupied the market share of Microsoft Lumia. In the current scenario Microsoft should use product development strategy to increase its market share and turn this segment into star.

Stars

Stars are those segments which have high market share and compete in high sales growth industry. Device and consumer segment of Microsoft Corporation, can be counted amongst the stars segments. Windows Operating systems and word processor (MS office), Mobile application and windows related software products and services are included in the mentioned segment. Apple and Google are the competition of Microsoft in D&C segment. Market development and product development strategies are suggested for stars segment according to BSG matrix.

Cash Cows

Microsoft computing and Gaming segment can be included into cash cow category. Cash cows are those segments, which operates in low sales growth industry but have high market share. Such segments are viable for companies to sustain its financial position for long term. Xbox one and Xbox 360 holds a big chunk of market share in gaming industry but yet Sony is the market leader in video game industry. Horizontal integration can help the corporation to grab largest market share in the industry. Microsoft computing and Gaming segment comprise of the following products and services, consoles of gaming and entertainment, royalties of second and third party video games, live subscription of Xbox platform devices and accessories, accessories of Microsoft PC.

Dogs

It is fortunate for Microsoft that, none of its segment fall into the category of dogs. Dogs are those segments which compete in low sales growth industry and have low relative market share. Such segments are liability on the organization. Liquidation strategy is suggested by BCG matrix for such segments.

Bcg Matrix Of Microsoft Company Information

References

Bcg Matrix Of Microsoft

MICROSOFT CORPORATION (MSFT). Retrieved from.

http://csimarket.com/stocks/competitionSEG2.php?code=MSFT

Annual report 2015. Retrieved from.

https://www.microsoft.com/investor/reports/ar15/index.html

Global unit sales of current generation video game consoles from 2008 to 2016 (in million units). Retrieved from.

https://www.statista.com/statistics/276768/global-unit-sales-of-video-game-consoles/

Desktop Operating System Market Share. Retrieved from.

https://www.netmarketshare.com/operating-system-market-share.aspx?qprid=10&qpcustomd=0

Bcg Matrix Of Microsoft Company Information

.